House Sale Tax Rules . You must have owned and used the home. Web you can sell your primary residence and be exempt from capital gains taxes on the first $250,000 if you are single and $500,000 if married. Web avoiding capital gains tax: The type of property sold or disposed of. Web there is a checklist of things to do when selling your property, such as paying outstanding tax, terminating existing giro. Web this publication explains the tax rules that apply when you sell or otherwise give up ownership of a home. The property is a residential property. Web not everyone will owe taxes for the sale of their home — there are plenty of exceptions and personal circumstances that will impact your tax. The date of purchase or acquisition. Capital gains tax is a levy imposed by the irs on the profits made from selling an investment or asset, including real. 121 home sale exclusion requirements.

from housewise.in

Web not everyone will owe taxes for the sale of their home — there are plenty of exceptions and personal circumstances that will impact your tax. The type of property sold or disposed of. Web this publication explains the tax rules that apply when you sell or otherwise give up ownership of a home. 121 home sale exclusion requirements. Web you can sell your primary residence and be exempt from capital gains taxes on the first $250,000 if you are single and $500,000 if married. You must have owned and used the home. Web avoiding capital gains tax: The property is a residential property. Web there is a checklist of things to do when selling your property, such as paying outstanding tax, terminating existing giro. The date of purchase or acquisition.

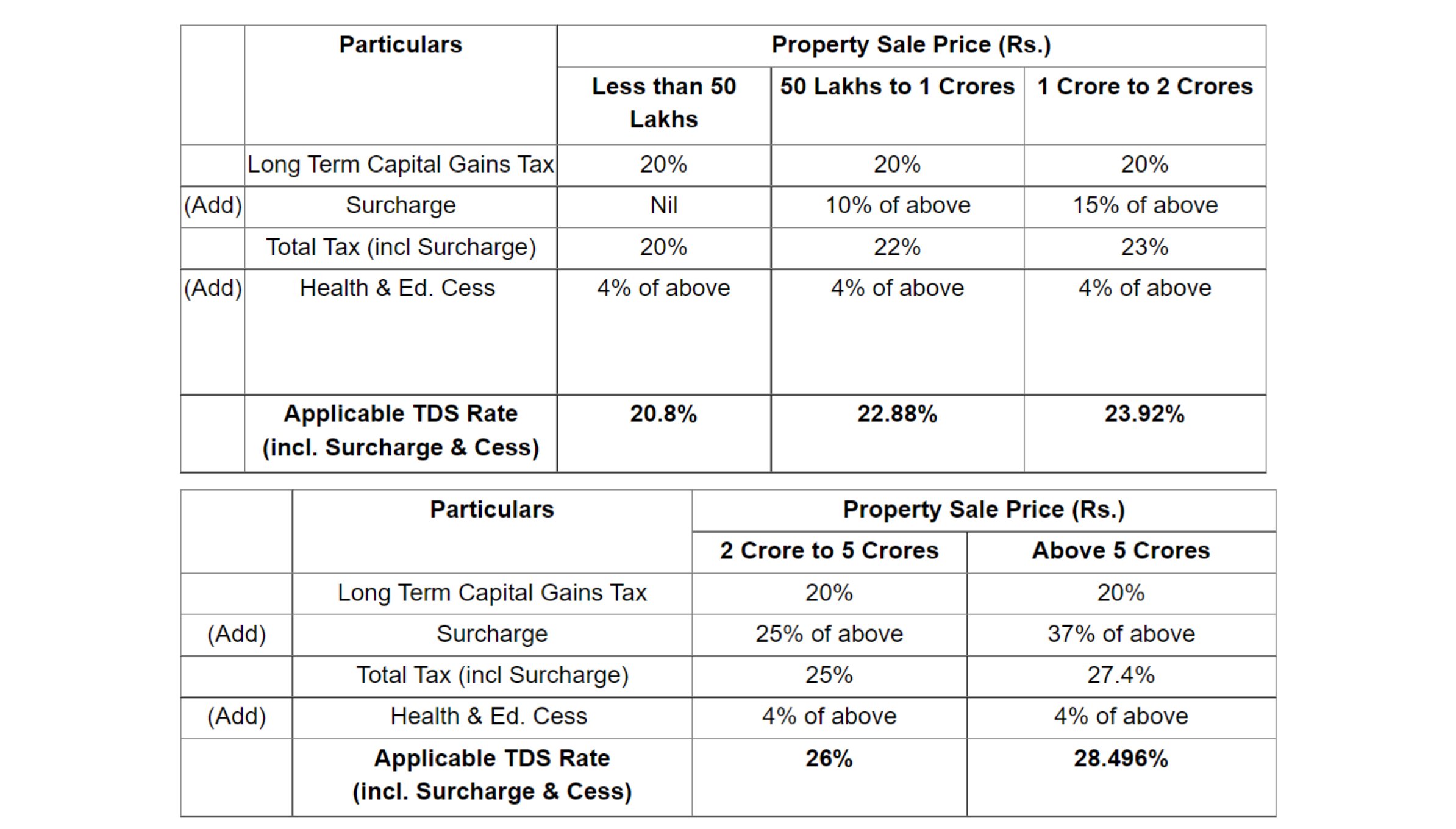

TDS rules while buying property from NRI Housewise

House Sale Tax Rules Capital gains tax is a levy imposed by the irs on the profits made from selling an investment or asset, including real. Web not everyone will owe taxes for the sale of their home — there are plenty of exceptions and personal circumstances that will impact your tax. The date of purchase or acquisition. 121 home sale exclusion requirements. Web there is a checklist of things to do when selling your property, such as paying outstanding tax, terminating existing giro. Capital gains tax is a levy imposed by the irs on the profits made from selling an investment or asset, including real. The type of property sold or disposed of. Web avoiding capital gains tax: The property is a residential property. You must have owned and used the home. Web you can sell your primary residence and be exempt from capital gains taxes on the first $250,000 if you are single and $500,000 if married. Web this publication explains the tax rules that apply when you sell or otherwise give up ownership of a home.

From www.simpleshowing.com

Tax Considerations for Foreign Nationals Purchasing US Real Estate House Sale Tax Rules Capital gains tax is a levy imposed by the irs on the profits made from selling an investment or asset, including real. The type of property sold or disposed of. Web avoiding capital gains tax: 121 home sale exclusion requirements. Web this publication explains the tax rules that apply when you sell or otherwise give up ownership of a home.. House Sale Tax Rules.

From mypropertyfile.co.uk

Demystifying House Sale Taxes What You Need to Know My Property File House Sale Tax Rules The property is a residential property. Capital gains tax is a levy imposed by the irs on the profits made from selling an investment or asset, including real. The type of property sold or disposed of. You must have owned and used the home. The date of purchase or acquisition. Web avoiding capital gains tax: Web there is a checklist. House Sale Tax Rules.

From thecolumbusceo.com

Property Taxes Are 16.8 Of Tax Revenue, Above U.S. Average House Sale Tax Rules Capital gains tax is a levy imposed by the irs on the profits made from selling an investment or asset, including real. The date of purchase or acquisition. The property is a residential property. Web you can sell your primary residence and be exempt from capital gains taxes on the first $250,000 if you are single and $500,000 if married.. House Sale Tax Rules.

From dailysignal.com

How High Are Property Taxes in Your State? House Sale Tax Rules 121 home sale exclusion requirements. You must have owned and used the home. Web this publication explains the tax rules that apply when you sell or otherwise give up ownership of a home. Web avoiding capital gains tax: The property is a residential property. Web there is a checklist of things to do when selling your property, such as paying. House Sale Tax Rules.

From www.informalnewz.com

Property Tax Rules tax has to be paid on selling gifted House Sale Tax Rules The property is a residential property. Web there is a checklist of things to do when selling your property, such as paying outstanding tax, terminating existing giro. Capital gains tax is a levy imposed by the irs on the profits made from selling an investment or asset, including real. Web avoiding capital gains tax: Web not everyone will owe taxes. House Sale Tax Rules.

From studylib.net

CENTRAL SALES TAX (REGISTRATION AND TURNOVER) RULES House Sale Tax Rules You must have owned and used the home. Web there is a checklist of things to do when selling your property, such as paying outstanding tax, terminating existing giro. The type of property sold or disposed of. The date of purchase or acquisition. Web this publication explains the tax rules that apply when you sell or otherwise give up ownership. House Sale Tax Rules.

From www.pinterest.com

How to Deduct Property Taxes On IRS Tax Forms Irs tax forms, Mortgage House Sale Tax Rules Web this publication explains the tax rules that apply when you sell or otherwise give up ownership of a home. You must have owned and used the home. The date of purchase or acquisition. Web not everyone will owe taxes for the sale of their home — there are plenty of exceptions and personal circumstances that will impact your tax.. House Sale Tax Rules.

From exolodshw.blob.core.windows.net

How To File Tax For House Sale at Nicole Santiago blog House Sale Tax Rules Web you can sell your primary residence and be exempt from capital gains taxes on the first $250,000 if you are single and $500,000 if married. Web avoiding capital gains tax: The property is a residential property. Web there is a checklist of things to do when selling your property, such as paying outstanding tax, terminating existing giro. Web not. House Sale Tax Rules.

From www.precisely.com

Online Sales Tax Rules Have Changed How Will Your Business Adapt House Sale Tax Rules Web you can sell your primary residence and be exempt from capital gains taxes on the first $250,000 if you are single and $500,000 if married. The property is a residential property. Web there is a checklist of things to do when selling your property, such as paying outstanding tax, terminating existing giro. The date of purchase or acquisition. Web. House Sale Tax Rules.

From www.patriotsoftware.com

Sales Tax Laws by State Ultimate Guide for Business Owners House Sale Tax Rules Web not everyone will owe taxes for the sale of their home — there are plenty of exceptions and personal circumstances that will impact your tax. Web you can sell your primary residence and be exempt from capital gains taxes on the first $250,000 if you are single and $500,000 if married. The date of purchase or acquisition. Web this. House Sale Tax Rules.

From silverlaw.ca

What do I need to know about Property Transfer Tax? Silver Law House Sale Tax Rules Web avoiding capital gains tax: You must have owned and used the home. The date of purchase or acquisition. Web there is a checklist of things to do when selling your property, such as paying outstanding tax, terminating existing giro. Web not everyone will owe taxes for the sale of their home — there are plenty of exceptions and personal. House Sale Tax Rules.

From www.saasant.com

A Complete Guide to Sales Tax For Small Business Owners SaasAnt Blog House Sale Tax Rules The type of property sold or disposed of. Web this publication explains the tax rules that apply when you sell or otherwise give up ownership of a home. You must have owned and used the home. 121 home sale exclusion requirements. Web avoiding capital gains tax: Web there is a checklist of things to do when selling your property, such. House Sale Tax Rules.

From thompsontax.com

Maine Sales & Use Tax Rules Leases & Rentals Thompson Tax House Sale Tax Rules Web you can sell your primary residence and be exempt from capital gains taxes on the first $250,000 if you are single and $500,000 if married. Web this publication explains the tax rules that apply when you sell or otherwise give up ownership of a home. Web avoiding capital gains tax: The type of property sold or disposed of. Web. House Sale Tax Rules.

From www.pinterest.com

a blue house with the words how to sell your primary residence and not House Sale Tax Rules Web avoiding capital gains tax: The type of property sold or disposed of. Web not everyone will owe taxes for the sale of their home — there are plenty of exceptions and personal circumstances that will impact your tax. Web there is a checklist of things to do when selling your property, such as paying outstanding tax, terminating existing giro.. House Sale Tax Rules.

From www.thebalancemoney.com

Home Sale Exclusion From Capital Gains Tax House Sale Tax Rules Capital gains tax is a levy imposed by the irs on the profits made from selling an investment or asset, including real. 121 home sale exclusion requirements. Web not everyone will owe taxes for the sale of their home — there are plenty of exceptions and personal circumstances that will impact your tax. Web you can sell your primary residence. House Sale Tax Rules.

From www.marketing91.com

What is Sales Tax? Advantages and Disadvantages of Sales tax House Sale Tax Rules Web there is a checklist of things to do when selling your property, such as paying outstanding tax, terminating existing giro. You must have owned and used the home. The date of purchase or acquisition. 121 home sale exclusion requirements. The property is a residential property. Web not everyone will owe taxes for the sale of their home — there. House Sale Tax Rules.

From quizzmagicfarris.z21.web.core.windows.net

Real Estate Sale Tax Worksheet House Sale Tax Rules Web not everyone will owe taxes for the sale of their home — there are plenty of exceptions and personal circumstances that will impact your tax. The date of purchase or acquisition. Web this publication explains the tax rules that apply when you sell or otherwise give up ownership of a home. Web you can sell your primary residence and. House Sale Tax Rules.

From taxfoundation.org

2021 Sales Tax Rates State & Local Sales Tax by State Tax Foundation House Sale Tax Rules Web this publication explains the tax rules that apply when you sell or otherwise give up ownership of a home. The type of property sold or disposed of. You must have owned and used the home. 121 home sale exclusion requirements. Capital gains tax is a levy imposed by the irs on the profits made from selling an investment or. House Sale Tax Rules.